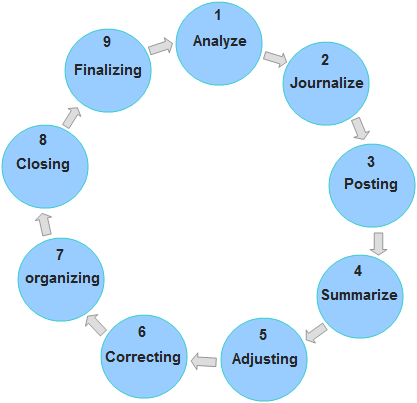

Frequent causes for discrepancies include incorrect adjusting entries, posting mistakes, or knowledge entry errors. Adjusting entries influence the earnings assertion by recognizing revenues and bills that were not beforehand recorded. Accruals and deferrals regulate the revenue and expense accounts, respectively, to match them with the relevant period. This ensures that the revenue assertion provides a extra accurate illustration of the company’s profitability. The subsequent step of the accounting cycle is to prepare the various accounts by making ready two important financial statements, particularly, the earnings assertion and the balance sheet. The revenue statement lists all bills incurred as well as all revenues collected by the entity throughout its financial period.

After the new entries are made, a model new trial steadiness is calculated to test if the debts are equal to the credits. The trial stability exhibits the balance of all of the accounts, together with “adjusted entries” on the end of an accounting interval. After this, the next step will assist us to research the monetary occasions that occurred in the firm throughout the accounting cycle.

If posting were carried out every day then the gross sales account in ledger will show whole and cumulative gross sales for the time interval Nine Steps In The Accounting Cycle until date. Debit is cash flowing into an account, and credit is money flowing out of it. The selection between accrual and money accounting affects when journal entries are made. Accrual accounting information events after they occur, not when money is exchanged. For occasion, monthly adjusting journal entries are wanted to match bills with revenues for every interval. Volopay has the capability to have a big impression on the accounting cycle steps and processes of any business.

This might imply offering quarterly coaching on greatest practices, meeting with your workers each cycle to find their ache points, or equipping them with the correct accounting tools. You would possibly discover early on that your system must be tweaked to accommodate your accounting habits. The stories part enables you to view and edit your inventory, taxes, gross sales, funds, and purchases whenever you want to. And lastly, you’ll find a way to create and view any financial statement with the click of a button.

Steps In The Accounting Cycle

Failing to carry out regular reconciliations, such as bank reconciliations or accounts receivable/payable reconciliations, may find yourself in discrepancies between accounting data and actual balances. Reconciliations assist identify errors, discrepancies, and inconsistencies in monetary data, guaranteeing accuracy in monetary reporting. After new entries are made, a model new trial balance is calculated to test if the debits are equal to credits. The trial steadiness exhibits the steadiness of all of the accounts which additionally consists of adjusting entries at the end of an accounting period. It will allow you to clear the financial events that happened within the firm throughout the accounting cycle. Closing short-term accounts is a crucial step within the accounting cycle, ensuring that your financial records replicate solely ongoing activities.

What Are Reversing Entries?

Larger businesses typically conduct extra frequent accounting cycles to make sure well timed monetary reporting and compliance. Automating the accounting cycle steps is a transformative process that streamlines monetary operations, reduces guide errors, and enhances total effectivity. By leveraging know-how, companies can focus more https://www.quickbooks-payroll.org/ on strategic decision-making rather than getting slowed down in repetitive tasks.

These changes ensure that the stability sheet presents a real image of the corporate’s monetary position. Journalizing transactions includes recording each financial transaction as a journal entry in the accounting journal. This step ensures all transactions are documented with details corresponding to dates, accounts affected, and amounts. The timing of the accounting cycle usually aligns with an organization’s fiscal 12 months, which may or might not coincide with the calendar yr. Nevertheless, within the broader annual cycle, organizations additionally carry out accounting processes on a more frequent basis—monthly, quarterly, or semi-annually—to preserve well timed and correct monetary records.

- This statement consolidates the revenues earned and bills incurred by the enterprise throughout an outlined period, similar to a month, quarter, or 12 months.

- By understanding the purpose and benefits of reversing entries, businesses can optimize their accounting practices and produce dependable financial information.

- The steadiness sheet presents a snapshot of the company’s financial position as of a selected date.

Thus, the companies put together a worksheet to track the errors in the report. As accountants identify the mistakes, they rectify the same within the worksheet to make sure debits are equal to credits. The first step of the accounting process is the evaluation of the transactions. First, the accountants collect, identify, and classify receipts, invoices, and different financial information.

The accounting cycle ensures that each one monetary transactions are accurately recorded and reported, offering stakeholders with dependable info. It helps compliance with accounting standards and aids in decision-making. Accounting software program has revolutionized the accounting cycle, automating many steps and reducing the chance of human error. Platforms like QuickBooks, Xero, and SAP streamline processes corresponding to posting journal entries, reconciling accounts, and producing financial statements.

This initial step entails capturing all enterprise actions that end in a financial impact. At the beginning of the following accounting interval, sometimes reversing journal entries are made to cancel out the accrual entries made in the earlier interval. After the reversing entries are posted, the accounting cycle starts all over again with the incidence of a new enterprise transaction. Other transactions or actions of the company indicated debit balances of $800 as Accounts Receivables and $100 inventory apart from $600 cash debit. As a outcome, the credit balances price $1,200 don’t balance with the debit balances of $1,500 in the trial balance. Thus, the bookkeeper has to find the lacking information to tally each the credit and debit sides.